Payroll Done Right

Payroll built to make your life easier.

We simplify the payroll process by providing qualified payroll professionals to help you avoid costly errors, tax risks and compliance liabilities.

Exceptional Payroll Services

Full service

payroll solutions.

Our Payroll Professionals specialize in the complexities of payroll taxes and government compliance. As part of our guaranteed services, we provide quick turn-around and accurate payroll and tax filing, including payroll record maintenance and management. We also offer PTO plan set up, accruals, balances and tracking, employee on-demand payroll access and 24/7 web-based employer reporting.

Our team of qualified CPAs are here to help you navigate the complexities of payroll tax management.

Payroll Tax Support

Complete payroll tax management.

We’ll handle Payroll tax submissions and preparation of compliance reports for all federal, state and local tax regulations and entities. We also provide automated and accurate employee documentation & submission to appropriate state agencies as well as management reports on all filings.

W-2 Processing

W-3 processing

Tax Credits

Tax return filing

Local Taxes

940 & 941 filings

State Unemployment

Unemployment Claims

State Withholding

Compliance & Risk Management

We’ll help you stay compliant with government regulations.

Maintaining compliance means adhering to specific policies and standards as required by law. Applied Business Solutions facilitates all industry specific government compliances for you, including monitoring state and federal laws, how these regulations impact your business and preparing and filing all necessary forms and documents.

Payroll Tax Management

Wage & Hour Compliance

Wage Garnishments

Unemployment Compensation

New Hire Reporting

Minimize your employer risk

By ensuring compliance with regulations and maintaining good employment practices, Applied reduces your risk, enabling your business to run smoothly-without road blocks.

Time & Labor Tracking

Get flexible time tracking options.

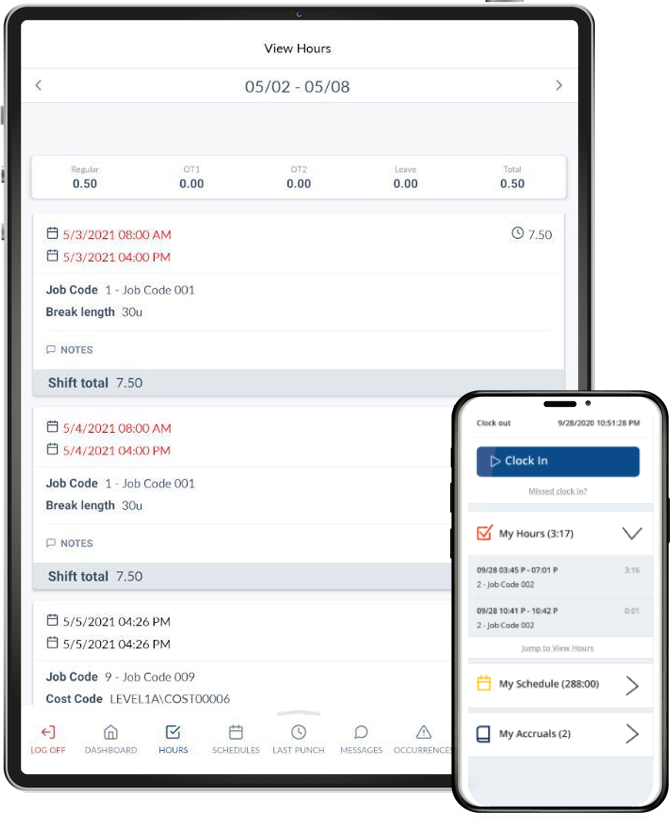

Integrated employee time-tracking software can quickly reduce your labor costs and help solve critical workforce management issues.

The Best Options at the Lowest Rates

Easy to budget time tools.

Your employees’ data flows seamlessly between Payroll, Benefits and HR so there’s no need to export and import timesheets between payrolls. Our Time & Labor tools can save you hours of administrative work while providing greater (and more accurate) visibility into your labor expenses.

Manager Dashboard

Mobile Application

Timesheet Entry

Advanced Scheduling

Time Off Approvals

Break Tracking

PTO Accrual Management

GPS location validation

Pay Rules Engine

Track, monitor & manage.

We offer multiple time-tracking software options, ranging from web-based browser entries to remote wall-mounted terminals; simply pick the option that best suites your business.

Gain clear visibility of your labor expenses.

Control wages and overtime by paying accurately and to the minute.

Complete tasks in minutes with smart and accurate employee time tracking.

Reduce the risk of compliance violations with automated timekeeping and reporting.

Time Tracking Options

Choose the best option for your business.

Get greater visibility into time and labor costs and simplify time management, PTO and scheduling with these convenient tools.

Webclock

With Webclock, employees can clock in and out using a web browser as well as change their cost centers throughout the day, view and approve hours, add notes to the segments, and even request time off.

Mobile App

Native applications for iOS and Android allow employees to clock in and out, view and approve their hours, and request time off. We can also utilize GPS stamp capabilities to tie clock operations to a physical location.

RDTg Terminals

Wall-mounted Remote Data Terminals allow employees to clock in and out, change their cost centers, view and approve their hours and request time off, and see messages sent through the Time and Labor system.

Timesheet Entry

Timesheet entry is available for employees with special duties that must be added to their timesheet later, or for salaried or classified individuals who need to enter time instead of clocking in-and-out for each shift.

Pay-As-You-Go Workers’ Comp

Workers’ Comp coverage made easy.

Accidents can happen anytime. With Applied Worker’s Comp Insurance, your business can eliminate premium financing and premium adjustments through a Pay-As-You-Go Worker’s Compensation program. Your premiums are based on your actual payroll and not projected annual payroll. This helps protect you from audit exposure because your premium is based on real-time payroll wages.

Run regular payroll

You will continue running payroll as usual to ensure up-to-date employee count and wage data.

Pay Your Premiums

Your premiums are then calculated per payroll cycle; eliminating large lump-sum payments.

Eliminate Audits

Audits are eliminated by paying 100% of your premium according to your payroll cycle.

What is workers compensation?

Workers’ Compensation is a form of insurance to help cover injured or sick employees’ medical expenses, as well as help replace wages from lost work time. Workers Comp also helps protect employers from potential lawsuits due to possible negligence.

What is a Workers' Comp Audit?

A workers' comp audit is the examination of a policyholder's financial and payroll records to determine the accuracy of the estimated premium when the policy was started.

Get the Best Options at the Lowest Rates

Save money with Pay-As-You-Go

Premium Adjustments: This allows you to match premium payments to your exact employment levels for the pay period. The premium amount will adjust up or down based on your staffing needs, ensuring that you never pay a penny more than necessary.

Improved Cash Flow: Workers’ compensation premiums are spread out over each payroll period and your premiums are based on your business needs. This improves cash flow and ensures that your expenses match your business operations.

Automated Payments: Nearly every insurance company that offers pay as you go coverage can also automatically collect your premiums with each payroll and debit your bank account. This is one less thing to remember and one less task to manage.

Learn more about Applied payroll services.

Payroll Support

An all-in-one flexible payroll suite that seamlessly integrates with all of your business services.

Advanced Tax Management

We provide a team of dedicated Payroll Professionals & Public Accountants.

Flexible Time Tracking

Easily sync your hours worked with payroll using our customizable time tracking software.

24/7 Online Portal

Easily and quickly review time cards, time off requests, monitor payroll and more.

Compliance Management

We facilitate all industry specific state and federal government compliance laws.

Easy Sign-On Process

Fast & effecient. Minimize the amount of time spent switching your payroll provider.

Ready to get started?

Want to learn what Applied can do for you? Find out more with a risk-free request for proposal — a member of our leadership team will happily answer your questions.