Service Platform

Benefits Overview

Benefits Features

Employee Benefits

Benefits built for your business.

Offer your employees access to health benefits including provisions for Major Medical Health Insurance, Group Supplemental Products, Dental, Vision and more.

Complete Benefits Administration

Manage your benefit administration in one place.

Businesses partnering with Applied Business Solutions have access to employee benefits normally offered only by larger companies, allowing them to attract quality employees on a level playing field and save money on their benefit packages with our competitive pricing. Clients may choose from multiple ACA compliant plans based on specific needs and receive online access to health information, claims and other resources.

Flexible Benefits Options

Select from a wide-variety of coverage options.

Master Medical Health Insurance

A Health Insurance Master Plan can change your entire benefits landscape, save you money, and be a critical piece in retaining and attracting the right employees.

By enrolling in our Master Health Plan, your employees will continue to be individually underwritten and covered by your company’s plan, however they will also be pooled with several other businesses for underwriting purposes. This allows all of our clients to be represented as a much larger organization, resulting in better plans at lower premiums for your employees.

We partner with Florida Blue Cross/Blue Shield to provide our clients with significant savings that may partially or even fully offset the cost of your human resources, payroll and tax-compliant administrative services.

Improved rates

Smaller companies can be underwritten with much larger organizations, resulting in lower rates and more affordable coverage.

Retain employees

Improve employee loyalty by providing health insurance, thereby retaining staff and lowering the cost of onboarding.

Attract talent

Attract and retain talent by offering health insurance coverage that competes with competitors on a leveled playing field.

Save money

Offering a Master Health Plan will make healthcare insurance more affordable as well as improve cash flow for your business.

Basic & Supplemental Life Insurance

Peace of mind for your employees knowing their loved ones are financially protected with group life insurance.

Dental

Various coverage levels with no waiting period.

Vision

Various coverage levels with no waiting period.

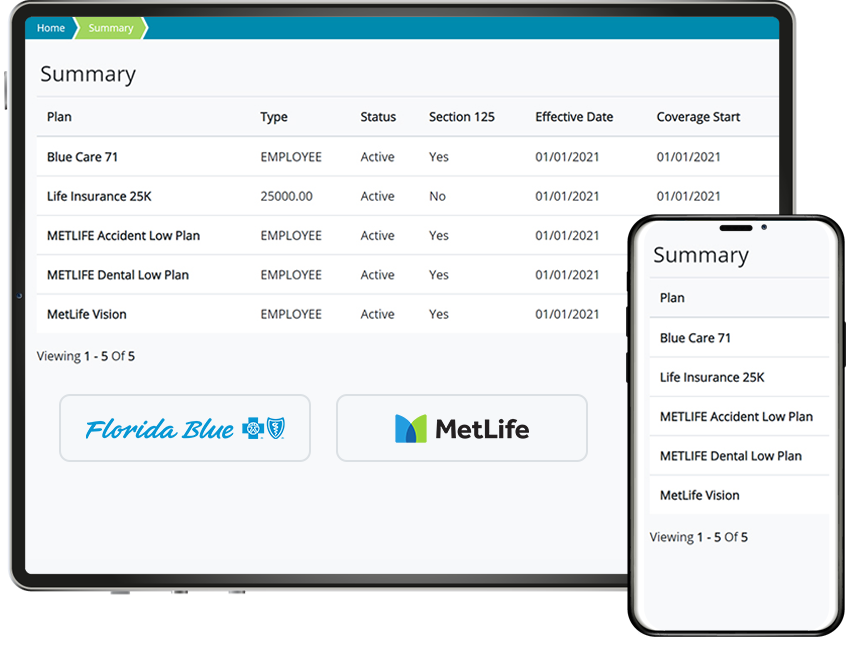

Secure Electronic Benefits Enrollment

Utilizing our secure electronic enrollment portal makes it easy for employees to view, compare, select or change elections from any device during the open enrollment period. Employees can track their payroll deductions, and managers / HR administrators can easily track employee enrollment statuses and ensure their selections are properly completed.

Hospital Indemnity

Hospital Indemnity supplements your existing health insurance coverage by providing a daily lump sum benefit in the event you or a covered family member is admitted or confined in the hospital.

Critical Illness Insurance

Critical Illness Insurance provides a lump sum benefit in the event you or a covered family member is diagnosed with Cancer, Cardiovascular Disease, Heart Attack, Stroke, and/or other qualifying conditions. This plan will also pay lump sum payments upon diagnosis.

Accident Coverage

Accident Coverage supplements your existing health insurance coverage by providing a lump sum benefit in the event you or a covered family member have an accidental injury.

Short- & Long-Term Disability

Short-Term Disability is intended to cover you immediately following a serious illness or injury. Long-Term Disability insurance is intended to maintain income replacement if your condition keeps you out of work past the end of your short-term disability benefit period.

Flexible Spending / Health Savings Accounts

FSAs & HSAs are accounts used to save on taxes and pay for qualified medical, prescription, dental and vision expenses.

Legal Insurance

Convenient options for seeking legal services.

Pet Insurance

Coverage for unplanned vet expenses and more.

Already have benefits and want to keep them? Not a problem!

We can still help manage your deductions and contributions for your existing plans… Ask us how.

Discover plans that work for you.

Medical coverage is a valuable benefit that helps cover the cost of care when your employees become sick or injured. It will also encourage them to maintain good health by providing and covering preventative care. When offering Major Medical Health Insurance coverage, it’s important to consider:

Which plans best fit your employee’s healthcare criteria

Offering employees extensive networks of participating hospitals & specialists

How offered healthcare coverage compares with similar market plans

Ready to get started?

Curious to learn how employee benefits could benefit your business or ready to dive in? Find out more with a risk-free request for proposal — a member of our leadership team will happily answer your questions.